Lifestyle

Biophilic Designs: The Fascination for Floral Designs in Rugs and Their Use

People in the UK love natural heritage and wildlife. However, their connection with Mother Nature is not limited to outdoors, including parks and gardens. They enjoy the essence of nature even within the four walls of their homes. If you also admire the bounty of natural elements, you will be able to relate to the prevalent emotions in this context. Different people use different techniques to bring the outdoor charm indoors. Some install houseplants; others cover their walls with nature-inspired paintings. How do you do this? Focus on rugs if you have been thinking about appropriate décor options. There is a growing craze for them due to various reasons.

You can make them a part of your home to introduce nature’s elements in their most beautiful, accessible, and uniquely tactile form. Choose floral rugs to experience the magic.

- Common flower patterns in rugs

Floral designs can be created on wool, silk, wool & bamboo silk, wool & silk, polyester, and viscose surfaces. Many wool rugs depict garden imagery weaved through colourful threads. These ancient designs are inspired by Indian, Turkish, and Persian cultures. Some can also capture the springtime spirit by representing leafy trees, water, birds, and animals among flowers. These multi-coloured designs speak of abundance, fresh energy, and delightful feelings. Many rugs can also contain boastful blooms to create poetic effects. These are iconic motifs and not clinical shapes. These can be small or large-size motifs. Even modern rugs can capture some oversized features in their traditional versions. Check transitional varieties for an idea.

Other options can include rosette motifs with serrated leaves, palmette or fan-like shapes, tribal angular or octagonal emblems, paisleys, lotus, tulips, carnations, tendril-like botanical decoration, poppies, cockscomb, etc. However, rugs with rose flowers may attract your attention because they suit contemporary and classic décor. Eye-catching large roses typically embody minute details and become the hero of the décor. Delicate stylised roses have a more subtle vibe to them.

- Why do you need a floral rug in your home?

Leaving aside the artistic work and detailing, floral designs in the rugs exude a mesmerising sophistication. They offer an unspoken romantic touch. Pair them with warm-coloured wood furniture to witness the magic. If you have a contemporary décor, you can go bold with these rug styles. Choose irregular shapes with rose or other floral patterns.

Nevertheless, floral designs can be available on hand-knotted, hand-tufted, flatweave, and handloom rugs. Every construction style is nuanced and significant. Hand-knotted rugs offer rich textures, while hand-tufted rugs enjoy a plush look. Flat-woven rugs are durable and mainly emphasise traditional patterns. You can pick a wool rug with flowers and other depictions to enhance your room’s luxurious appeal. If you need something for your bedroom or small living spaces, a rug size of 5×8 inches can be suitable. 8X10 inches of rug can be a perfect fit for spacious areas. Open floor plans often benefit from this size.

People generally believe that playing with floral designs is challenging. On the contrary, they are the most flexible options. You can pick a specific hue in the rug and delightfully tie the entire room’s look. Use one as a statement piece and another as an obedient decor partner if you wish.

Lifestyle

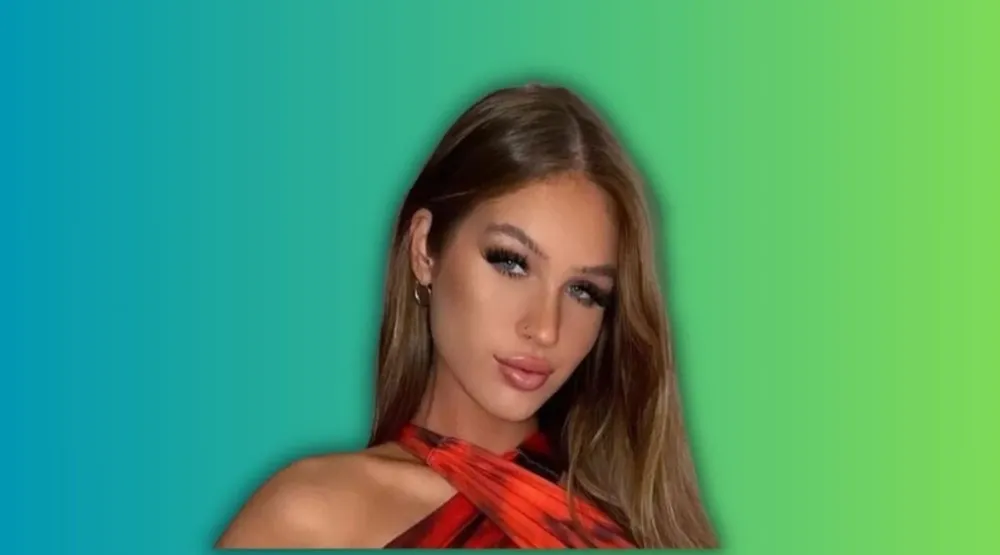

Ski Bri Net Worth – How Much Is Sky Bri Worth in 2024?

Alright, let’s talk about Ski Bri net worth. You know, that social media queen who’s been blowing up your TikTok feed? Yeah, her. If you’ve ever wondered, “How much is Sky Bri worth?”—you’re not alone. By 2024, her net worth is sitting pretty in the

2to

2to3 million range. But how did she get there? Let’s break it down, human-style.

Who Is Ski Bri? (And Why Should You Care?)

First things first—who even is Ski Bri? Real name: Sky Brianna. She’s a social media influencer, model, and content creator who’s basically the poster child for turning likes into dollars. You’ve probably seen her on Instagram, TikTok, or YouTube, serving looks and dropping relatable content like it’s her job. (Spoiler: it is.)

Early Life and Career Beginnings

Ski Bri grew up in the U.S., and like most of us, she started small. Think awkward teen photos and cringe-worthy captions. But here’s the thing—she had a knack for fashion and beauty. By her late teens, she was posting on Instagram, and people actually cared. Like, a lot. Her follower count shot up faster than my anxiety during a Wi-Fi outage.

Rise to Fame

Fast forward past three failed attempts at going viral (we’ve all been there), and Ski Bri hit the jackpot with TikTok. Her short, snappy videos were the perfect mix of personality and polish. Then came YouTube—vlogs, beauty tutorials, and the kind of lifestyle content that makes you question your life choices. Suddenly, she wasn’t just another influencer; she was the influencer.

Ski Bri Net Worth in 2024: The Breakdown

Alright, let’s get to the good stuff. Ski Bri net worth in 2024? Somewhere between

2millionand

2millionand3 million. Not too shabby for someone who probably spends half her day filming herself eating avocado toast. But where’s all that cash coming from? Let’s dive in.

Income Sources

- Social Media Earnings: This is her bread and butter. With millions of followers across Instagram, TikTok, and YouTube, Ski Bri rakes in serious cash from sponsored posts, brand deals, and ad revenue. One viral TikTok? Cha-ching.

- Brand Partnerships: Ski Bri’s got brands lining up to work with her. Fashion, beauty, lifestyle—you name it, she’s probably promoting it. These deals aren’t just lucrative; they’re also a major flex.

- Merchandise Sales: Yep, she’s got merch. From hoodies to phone cases, her fans can’t get enough. It’s like owning a piece of the Ski Bri empire—or at least a $40 T-shirt.

- YouTube Revenue: Her YouTube channel is a goldmine. Millions of views mean serious ad dollars, plus sponsorships and affiliate marketing. Basically, every time you click, she gets paid.

- Modeling and Appearances: Ski Bri’s not just a screen star. She’s done modeling gigs and made appearances at events, adding another stream to her income river.

What Makes Ski Bri’s Net Worth So Impressive?

Here’s the kicker: Ski Bri didn’t just stumble into this wealth. She worked for it. Hard. Here’s what sets her apart:

- Consistency: She’s always posting, always engaging. Rain or shine, she’s there, serving content like it’s her last meal.

- Diversification: Ski Bri doesn’t put all her eggs in one basket. Social media, merch, brand deals—she’s got multiple income streams, which is just smart business.

- Brand Collaborations: Partnering with big names has boosted her credibility and her bank account. It’s not just about the money; it’s about building a legacy.

- Entrepreneurial Spirit: Launching her own merch line? That’s next-level hustle. She’s not just an influencer; she’s a businesswoman.

How Much Is Sky Bri Worth Compared to Other Influencers?

Okay, let’s put Ski Bri net worth into perspective. Compared to other influencers, she’s doing pretty damn well. Sure, she’s not at Emma Chamberlain’s $12 million level (yet), but she’s holding her own.

Influencers with Similar Net Worths

- Emma Chamberlain: $12 million. Coffee brand, podcast, YouTube—she’s the queen of diversification.

- Addison Rae: $8 million. TikTok fame turned into acting and music gigs.

- Charli D’Amelio: $20 million. The most followed TikTok star with a merch line and brand deals for days.

Ski Bri might not be in their league yet, but she’s climbing the ladder. Fast.

The Future of Ski Bri’s Net Worth

So, what’s next for Ski Bri? Honestly, the sky’s the limit (pun absolutely intended). Here’s where her net worth could go from here:

- Expanding Her Merch Line: More products, more sales, more money. Simple math.

- New Platforms: Twitch, Patreon, or even a podcast could open up new revenue streams.

- Acting and Entertainment: She’s already dabbled in modeling. Acting could be the next step.

- Investments: Real estate, stocks, or even her own brand. The possibilities are endless.

Wrapping It Up

Anyway, here’s the kicker: Ski Bri net worth in 2024 is a testament to her hustle. She’s not just another influencer; she’s a brand, a business, and a force to be reckoned with. Whether you’re a fan or just curious about the money behind the fame, one thing’s clear—Ski Bri is killing it.

Lifestyle

Is Michelle Smallmon Married? Age, Spouse & Salary Details

Michelle Smallmon is one of those voices you can’t ignore if you’re into sports radio. She’s got this way of breaking down plays and stats that makes you feel like you’re sitting right there with her, arguing over whether the Rams made the right call. But here’s the thing—while we know a lot about her professional life, her personal life? Not so much. So, let’s dig into the burning questions: Is Michelle Smallmon married? How old is she? And what’s the deal with her salary?

Who Is Michelle Smallmon?

Before we get into whether Michelle Smallmon married or not, let’s talk about who she is. Michelle’s a St. Louis native, born and raised. She’s one of those people who just gets sports. Like, she could probably tell you the batting average of a backup catcher from 2003 off the top of her head.

She went to the University of Missouri (Mizzou, for the locals) and studied journalism. From there, she hustled her way into sports radio, starting with internships and working her way up. Now, she’s a big deal at 101 ESPN, co-hosting The Fast Lane and making regular appearances on The Ryen Russillo Show.

Michelle Smallmon’s Early Life and Career

Okay, so here’s the thing about Michelle—she didn’t just wake up one day and land a gig on ESPN. Nope. She put in the work. Rain. Late nights. Probably a lot of caffeine. That’s how she got here.

She grew up in St. Louis, which, if you know anything about sports towns, is a place where people live and breathe their teams. Cardinals baseball. Blues hockey. Rams football (back in the day). That’s where her love for sports started.

Fast forward past a few internships and a lot of hustle, and she’s now one of the most recognizable voices in sports radio. Not bad, right?

Is Michelle Smallmon Married? Let’s Talk About Her Personal Life

Alright, here’s the part y’all are probably here for: Is Michelle Smallmon married? I mean, it’s the question everyone’s asking.

Michelle Smallmon Married: The Truth

Here’s the deal—Michelle’s pretty private about her personal life. Like, really private. There’s no ring on her finger in any of her social media pics, and she hasn’t mentioned a spouse or partner in any interviews. So, as far as we know, Michelle Smallmon married life is either a mystery or she’s flying solo.

And honestly? Good for her. Not everyone needs to broadcast their relationship status to the world.

Michelle Smallmon’s Age: How Old Is She?

Now, let’s talk about her age. Michelle’s one of those people who looks like she could be 25 or 45, depending on the lighting. But based on what we know, she was born in the early 1980s, which puts her around 40 years old as of 2023.

Fun fact: She’s been in the sports radio game for over a decade now. That’s a lot of hot takes and late-night call-ins.

Michelle Smallmon’s Career and Salary Details

Let’s get into the nitty-gritty: Michelle Smallmon salary. Because, let’s be real, we’re all a little nosy when it comes to how much people make.

Michelle Smallmon Salary: How Much Does She Earn?

So, here’s the thing—Michelle’s exact salary isn’t public knowledge. But if we’re going by industry standards, a sports radio host with her experience and popularity is probably pulling in somewhere between

60,000and

60,000and150,000 a year.

And considering she’s at 101 ESPN, which is a major player in the sports radio world, I’d bet she’s on the higher end of that range. Plus, she’s got her work with Ryen Russillo, which probably adds a nice little bonus to her paycheck.

Career Highlights and Achievements

Michelle’s career is stacked with wins. Here’s a quick rundown:

- Co-host of The Fast Lane: This is her main gig, and it’s a big one.

- Contributor to The Ryen Russillo Show: Because apparently, she doesn’t sleep.

- Community Involvement: She’s big on giving back, whether it’s charity events or supporting local sports programs.

Michelle Smallmon Wikipedia: What’s on Her Page?

If you’re looking for the CliffsNotes version of Michelle’s life, her Wikipedia page is a good place to start. It’s not super detailed, but it hits the highlights.

Key Points from Michelle Smallmon Wikipedia

- Born and raised in St. Louis: Because of course she was.

- University of Missouri grad: Journalism degree, because she’s a pro.

- Career: Sports radio host and producer. Duh.

- Personal Life: Private. Like, really private.

Michelle Smallmon’s Impact on Sports Radio

Michelle’s not just a voice on the radio—she’s a trailblazer. Women in sports media? It’s not an easy gig. But Michelle’s out here proving that you can be smart, funny, and know your stuff, all while breaking down barriers.

Challenges Faced by Women in Sports Media

Let’s be real—sports media is still a boys’ club. But Michelle’s been holding her own for years. She’s had to work twice as hard to get half the recognition, but she’s done it. And she’s made it look easy.

Michelle Smallmon’s Future Prospects

So, what’s next for Michelle? Honestly, the sky’s the limit.

Potential Career Moves

- Podcasting: Because who doesn’t love a good podcast?

- Mentorship: She’d be an amazing mentor for up-and-coming sports broadcasters.

- More Community Work: Because she’s just that kind of person.

Conclusion: Michelle Smallmon’s Legacy

At the end of the day, Michelle Smallmon is more than just a sports radio host. She’s a role model, a trailblazer, and a damn good broadcaster.

Final Thoughts

So, is Michelle Smallmon married? Who knows. And honestly, who cares? What matters is what she’s doing in the world of sports media. She’s killing it, and we’re here for it.

Lifestyle

Jelly Bean Brains Real Name & Age – Uncover the Identity

Let’s talk about Jelly Bean Brains. You know, the internet’s favorite enigma. Their quirky content? Hilarious. Their mysterious persona? Intriguing. But here’s the thing—what’s Jelly Bean Brains real name? And how old are they? I’ve been down this rabbit hole, and trust me, it’s a wild ride.

Who Is Jelly Bean Brains?

Jelly Bean Brains is that social media star who makes you laugh, think, and sometimes go, “Wait, what?” Their TikTok, Instagram, and YouTube content is a mix of humor, creativity, and pure chaos. But here’s the kicker: no one knows their jellybeanbrains real name.

The Name That Started It All

“Jelly Bean Brains.” It’s catchy, right? It’s the kind of name that sticks in your head like a song you can’t shake. But why that name? Is it a metaphor for their thought process? A nod to their love of candy? Or just something they came up with at 3 a.m. during a snack break?

Anyway, the mystery of jellybeanbrains name is part of what makes them so fascinating. It’s like trying to solve a puzzle with half the pieces missing.

Why Keep Jelly Bean Brains Real Name a Secret?

Let’s be real—privacy is a hot commodity these days. Jelly Bean Brains might just be protecting their sanity. I mean, imagine having millions of people knowing your real name. No thanks.

Here’s why they might be staying anonymous:

- Privacy: Separating their online life from their real life. Smart move.

- Branding: “Jelly Bean Brains” is a vibe. A real name might ruin the magic.

- Mystery: Let’s face it, we’re all suckers for a good mystery.

The Internet’s Wild Guesses About Jelly Bean Brains Real Name

Oh, the theories. Some folks think Jelly Bean Brains real name is something equally quirky, like “Skylar Moonbeam” or “Ziggy Stardust.” Others swear it’s something super basic, like “Sarah” or “John.” Honestly, I’m leaning toward something in between—maybe “Alex J. Bean”?

But hey, that’s just me guessing. The truth? Still out there.

Jelly Bean Brains Age: How Old Are They?

Alright, let’s tackle the other big question: jellybeanbrains age. They haven’t exactly posted their birth certificate online (shocking, I know), but we can make some educated guesses.

Clues About Their Age

- Content Style: Their videos scream “Gen Z energy.” Think late teens or early twenties.

- Platforms: TikTok is their playground, and that’s where the cool kids hang out.

- Collabs: They’ve teamed up with other influencers who are, like, 20-something.

So, yeah, jelly bean brains age is probably in that range. But don’t quote me on that.

The Rise of Jelly Bean Brains

Let’s rewind a bit. How did Jelly Bean Brains become, well, Jelly Bean Brains?

- Early Days: Started with TikTok videos that were equal parts weird and wonderful.

- Viral Moments: One video about, I don’t know, a talking toaster or something, blew up.

- Expansion: Took over Instagram and YouTube like a boss.

Fast forward past three failed attempts to recreate their magic (seriously, how do they do it?), and here we are.

The Impact of Jelly Bean Brains

Jelly Bean Brains isn’t just entertaining—they’re inspiring. Their content shows that you don’t need a fancy setup or a Hollywood budget to make people laugh. Just a killer idea and a whole lot of personality.

The Search for Jelly Bean Brains Real Name Continues

Despite all the digging, jellybeanbrains real name remains a mystery. It’s like trying to find Waldo in a sea of stripes.

Why We’re Obsessed

Let’s be honest—we all want to know Jelly Bean Brains real name. It’s human nature. We want to connect with the person behind the screen. But maybe the mystery is part of the charm.

The Future of Jelly Bean Brains

What’s next for Jelly Bean Brains? More viral videos? A tell-all interview? A cookbook titled 101 Ways to Eat Jelly Beans? Who knows.

What We Know So Far

- Alias: Jelly Bean Brains

- Platforms: TikTok, Instagram, YouTube

- Content: Pure chaos in the best way

- Age: Probably in their late teens or early twenties

Conclusion: The Enigma of Jelly Bean Brains

Jelly Bean Brains is a mystery wrapped in a riddle, dipped in jelly beans. The search for Jelly Bean Brains real name and jellybeanbrains age might never end, but that’s okay. Sometimes, the mystery is better than the answer.

Final Thoughts

Rain. Mud. A shovel. That’s how my search for jellybeanbrains real name began. Okay, not really, but you get the point. The internet is full of mysteries, and Jelly Bean Brains is one of the best.

-

Travel1 year ago

Travel1 year agoOnboardicafe.com Login Exploring the Delights of Onboardicafe

-

Food & Recipes12 months ago

Food & Recipes12 months agoFive Food Products You Must Avoid Giving to Your Infant

-

Sports1 year ago

Sports1 year agoThe Most Popular Sports In The World

-

Health & Fitness11 months ago

Health & Fitness11 months agoSuboxone Tooth Decay Lawsuits and the Pursuit of Justice Against Indivior

-

Sports10 months ago

Sports10 months agoSmart Solutions for Football Field Maintenance

-

Entertainment1 year ago

Entertainment1 year agoNavigating the Web: The Ultimate List of Tamilrockers Proxy Alternatives

-

Technology4 months ago

Technology4 months agoSustainable Practices in Video Production: Reducing the Carbon Footprint

-

Sports9 months ago

Sports9 months agoWearable Tech and the Future of Football