Lifestyle

Smart Tax Planning for You and Your Family’s Future: Strategies for Long-Term Financial Success

Navigating the complexities of taxes can feel overwhelming, but smart tax planning can significantly enhance financial security for families. Effective tax strategies not only reduce liabilities but also help optimize savings for future needs. By understanding various tax benefits and potential deductions, families can make informed decisions that will benefit them in the long run.

Many individuals overlook the importance of proactive tax planning, which can lead to missed opportunities and unexpected expenses. Engaging in thoughtful tax planning empowers families to build wealth, fund education, and prepare for retirement more effectively. Considering tax implications now will lead to better financial outcomes when it matters most. In this blog post, readers will discover practical tips and strategies for intelligent tax planning that aligns with their family’s financial goals. This knowledge can be a game changer in achieving long-term financial stability and peace of mind.

Understanding Tax Basics for Effective Planning

Familiarity with tax fundamentals is essential for effective financial planning. Key areas include income tax brackets, deductions, and credits, which significantly impact a taxpayer’s liability.

Income Tax Brackets and Rates

The income tax system in the United States is progressive, meaning that as an individual’s income increases, it is taxed at higher rates. Taxpayers fall into specific brackets based on their taxable income, which is adjusted annually. For example, in 2024, the federal income tax rates are typically structured as follows:

| Income Bracket | Tax Rate |

| $0 – $11,000 | 10% |

| $11,001 – $44,725 | 12% |

| $44,726 – $95,375 | 22% |

| $95,376 – $182,100 | 24% |

| Above $182,100 | 32% – 37% |

Understanding these brackets allows taxpayers to estimate their liabilities accurately and potentially adjust their taxable income through deductions.

Standard Deduction vs. Itemized Deductions

Taxpayers can choose between the standard deduction and itemizing deductions when calculating taxable income. The standard deduction is a fixed dollar amount that reduces taxable income. For 2024, the standard deduction amounts are:

- Single: $14,600

- Married Filing Jointly: $29,200

- Head of Household: $21,900

Conversely, itemized deductions allow taxpayers to list specific expenses, such as mortgage interest, medical expenses, and charitable contributions. Taxpayers must compare the two to determine which option offers the greater tax benefit.

Tax Credits and How They Reduce Tax Liability

Tax credits are direct reductions in the amount of tax owed, making them valuable tools for taxpayers. Unlike deductions, which reduce taxable income, credits decrease the total tax bill dollar-for-dollar. Various credits exist, including the Earned Income Tax Credit (EITC) and Child Tax Credit. For instance, the EITC can provide significant relief for low-to-moderate-income earners, while the Child Tax Credit can result in a larger refund for families with children. Knowing the available credits and their qualifications can lead to substantial tax savings and should be an integral part of tax planning for individuals and families.

Tax-Advantaged Investment Strategies

Tax-advantaged investment strategies provide individuals and families with opportunities to grow their wealth while minimizing their tax burdens. Understanding these strategies can lead to more effective financial planning and savings over time.

Retirement Accounts and Their Tax Benefits

Retirement accounts, such as 401(k)s and IRAs, offer significant tax advantages. Contributions to traditional IRAs and 401(k)s can be made with pre-tax dollars, reducing taxable income in the current year. The funds grow tax-deferred until withdrawal, allowing for potential compound growth. Roth IRAs provide tax-free growth and tax-free withdrawals in retirement, but contributions are made with after-tax dollars. Employers may match contributions to 401(k) plans, maximizing the benefit for employees. Understanding the contribution limits is essential. For example, in 2024, individuals can contribute up to $6,500 to an IRA, or $7,500 if age 50 or older. Knowing how to leverage these accounts can significantly impact long-term financial health.

Education Savings Plans for Your Family’s Future

Education savings plans, particularly 529 plans, offer tax advantages for education expenses. Contributions to these plans grow tax-free, and withdrawals for qualified education expenses are also tax-exempt. In many states, contributing to a 529 plan may also provide state tax deductions. It’s important to compare plans based on fees and investment options, as they can vary widely. Coverdell Education Savings Accounts (ESAs) are another option. They allow for tax-free growth and help cover qualifying education expenses, including K-12 tuition. The contribution limit for ESAs is $2,000 per year per beneficiary.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

HSAs provide a triple tax advantage. Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. To be eligible for an HSA, an individual must be enrolled in a high-deductible health plan. Contribution limits are set annually; for 2024, the limit is $3,850 for individuals and $7,750 for families. Individuals aged 55 and older can contribute an additional $1,000. FSAs allow employees to set aside pre-tax income for out-of-pocket medical expenses, offering immediate tax benefits. Unlike HSAs, FSAs are typically “use it or lose it,” meaning funds must be used by the end of the plan year. These accounts are effective tools for managing healthcare costs while minimizing tax liabilities.

Estate Planning and Inheritance Tax Considerations

Effective estate planning incorporates strategies to minimize inheritance taxes while ensuring the smooth transition of assets. Understanding trusts and gift tax rules can significantly influence long-term financial outcomes for families.

Using Trusts for Tax Efficiency

Trusts can serve as an effective tool for tax efficiency in estate planning. They help transfer assets outside of probate, which can reduce associated fees and expedite the distribution process. Types of Trusts:

- Revocable Trusts: Allows for changes during the grantor’s lifetime but does not provide tax benefits until the grantor’s death.

- Irrevocable Trusts: Assets transferred are no longer owned by the grantor, potentially lowering estate taxes.

Setting up a trust may also provide protection from creditors and ensure privacy concerning asset distribution. They can be tailored to meet specific needs, supporting customized wealth distribution strategies while minimizing tax liability.

Gift Tax Rules and Exclusions

Understanding gift tax rules is crucial for effective estate planning. The IRS allows individuals to gift a certain amount per recipient each year without incurring tax, known as the annual exclusion. Current Exclusions:

- Annual Exclusion Limit: For 2024, this amount is $17,000 per recipient.

- Lifetime Exclusion: Beyond the annual exclusion, individuals can gift up to a lifetime total of $12.92 million, which counts against their estate tax exemption.

Gifts can also be made for educational and medical expenses without triggering gift tax, allowing for strategic planning. Utilizing these exclusions effectively can lower the taxable estate, benefiting family finances in the long run.

Year-Round Tax Planning Techniques

Effective tax planning strategies can significantly impact a family’s financial future. Understanding specific techniques can lead to maximized savings and better financial decisions throughout the year.

Charitable Giving and Tax Deductions

Making charitable donations can provide taxpayers with valuable tax deductions. Contributions to qualified charitable organizations can reduce taxable income, potentially lowering the overall tax liability. Taxpayers should keep thorough records of their donations, including receipts and acknowledgment letters from charities. It’s essential to know the deduction limits; typically, cash contributions can be deducted up to 60% of adjusted gross income (AGI), while property donations may vary. Engaging in donor-advised funds (DAFs) can also be beneficial. DAFs allow individuals to make charitable contributions, receive immediate tax benefits, and distribute funds to charities over time. This approach encourages strategic planning around charitable giving.

Tax Loss Harvesting in Investment Portfolios

Tax loss harvesting is a technique where investors sell securities at a loss to offset capital gains tax. This strategy can help reduce the tax burden, making it an essential part of year-round tax planning. Investors should regularly review their portfolios to identify underperforming assets. Selling these assets can realize losses, which can then offset gains from other investments. It is important to be aware of the “wash sale” rule, which prevents claiming a loss if the same or a substantially identical security is repurchased within 30 days. By carefully timing sales and future purchases, investors can strategically minimize taxes and maintain portfolio integrity.

Read More latest Posts

Lifestyle

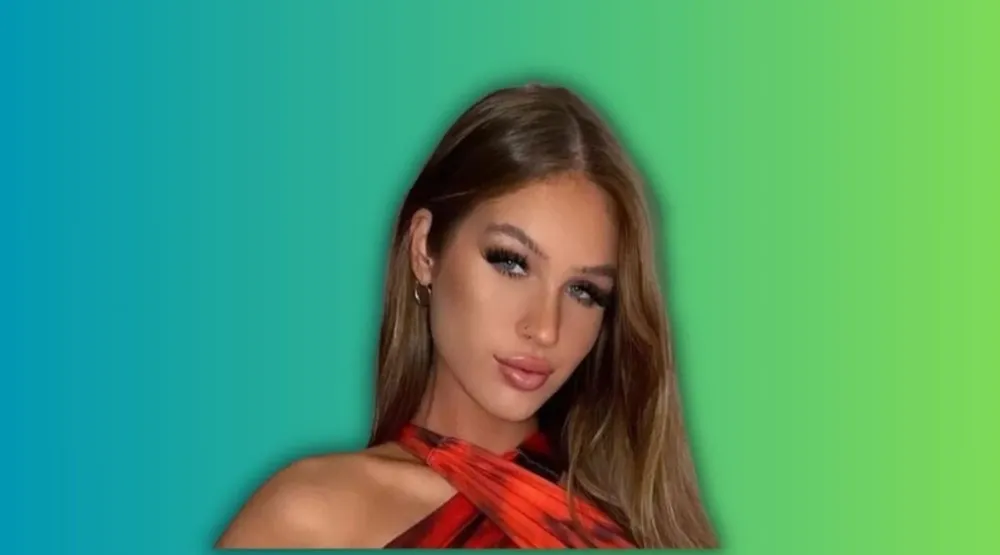

Ski Bri Net Worth – How Much Is Sky Bri Worth in 2024?

Alright, let’s talk about Ski Bri net worth. You know, that social media queen who’s been blowing up your TikTok feed? Yeah, her. If you’ve ever wondered, “How much is Sky Bri worth?”—you’re not alone. By 2024, her net worth is sitting pretty in the

2to

2to3 million range. But how did she get there? Let’s break it down, human-style.

Who Is Ski Bri? (And Why Should You Care?)

First things first—who even is Ski Bri? Real name: Sky Brianna. She’s a social media influencer, model, and content creator who’s basically the poster child for turning likes into dollars. You’ve probably seen her on Instagram, TikTok, or YouTube, serving looks and dropping relatable content like it’s her job. (Spoiler: it is.)

Early Life and Career Beginnings

Ski Bri grew up in the U.S., and like most of us, she started small. Think awkward teen photos and cringe-worthy captions. But here’s the thing—she had a knack for fashion and beauty. By her late teens, she was posting on Instagram, and people actually cared. Like, a lot. Her follower count shot up faster than my anxiety during a Wi-Fi outage.

Rise to Fame

Fast forward past three failed attempts at going viral (we’ve all been there), and Ski Bri hit the jackpot with TikTok. Her short, snappy videos were the perfect mix of personality and polish. Then came YouTube—vlogs, beauty tutorials, and the kind of lifestyle content that makes you question your life choices. Suddenly, she wasn’t just another influencer; she was the influencer.

Ski Bri Net Worth in 2024: The Breakdown

Alright, let’s get to the good stuff. Ski Bri net worth in 2024? Somewhere between

2millionand

2millionand3 million. Not too shabby for someone who probably spends half her day filming herself eating avocado toast. But where’s all that cash coming from? Let’s dive in.

Income Sources

- Social Media Earnings: This is her bread and butter. With millions of followers across Instagram, TikTok, and YouTube, Ski Bri rakes in serious cash from sponsored posts, brand deals, and ad revenue. One viral TikTok? Cha-ching.

- Brand Partnerships: Ski Bri’s got brands lining up to work with her. Fashion, beauty, lifestyle—you name it, she’s probably promoting it. These deals aren’t just lucrative; they’re also a major flex.

- Merchandise Sales: Yep, she’s got merch. From hoodies to phone cases, her fans can’t get enough. It’s like owning a piece of the Ski Bri empire—or at least a $40 T-shirt.

- YouTube Revenue: Her YouTube channel is a goldmine. Millions of views mean serious ad dollars, plus sponsorships and affiliate marketing. Basically, every time you click, she gets paid.

- Modeling and Appearances: Ski Bri’s not just a screen star. She’s done modeling gigs and made appearances at events, adding another stream to her income river.

What Makes Ski Bri’s Net Worth So Impressive?

Here’s the kicker: Ski Bri didn’t just stumble into this wealth. She worked for it. Hard. Here’s what sets her apart:

- Consistency: She’s always posting, always engaging. Rain or shine, she’s there, serving content like it’s her last meal.

- Diversification: Ski Bri doesn’t put all her eggs in one basket. Social media, merch, brand deals—she’s got multiple income streams, which is just smart business.

- Brand Collaborations: Partnering with big names has boosted her credibility and her bank account. It’s not just about the money; it’s about building a legacy.

- Entrepreneurial Spirit: Launching her own merch line? That’s next-level hustle. She’s not just an influencer; she’s a businesswoman.

How Much Is Sky Bri Worth Compared to Other Influencers?

Okay, let’s put Ski Bri net worth into perspective. Compared to other influencers, she’s doing pretty damn well. Sure, she’s not at Emma Chamberlain’s $12 million level (yet), but she’s holding her own.

Influencers with Similar Net Worths

- Emma Chamberlain: $12 million. Coffee brand, podcast, YouTube—she’s the queen of diversification.

- Addison Rae: $8 million. TikTok fame turned into acting and music gigs.

- Charli D’Amelio: $20 million. The most followed TikTok star with a merch line and brand deals for days.

Ski Bri might not be in their league yet, but she’s climbing the ladder. Fast.

The Future of Ski Bri’s Net Worth

So, what’s next for Ski Bri? Honestly, the sky’s the limit (pun absolutely intended). Here’s where her net worth could go from here:

- Expanding Her Merch Line: More products, more sales, more money. Simple math.

- New Platforms: Twitch, Patreon, or even a podcast could open up new revenue streams.

- Acting and Entertainment: She’s already dabbled in modeling. Acting could be the next step.

- Investments: Real estate, stocks, or even her own brand. The possibilities are endless.

Wrapping It Up

Anyway, here’s the kicker: Ski Bri net worth in 2024 is a testament to her hustle. She’s not just another influencer; she’s a brand, a business, and a force to be reckoned with. Whether you’re a fan or just curious about the money behind the fame, one thing’s clear—Ski Bri is killing it.

Lifestyle

Is Michelle Smallmon Married? Age, Spouse & Salary Details

Michelle Smallmon is one of those voices you can’t ignore if you’re into sports radio. She’s got this way of breaking down plays and stats that makes you feel like you’re sitting right there with her, arguing over whether the Rams made the right call. But here’s the thing—while we know a lot about her professional life, her personal life? Not so much. So, let’s dig into the burning questions: Is Michelle Smallmon married? How old is she? And what’s the deal with her salary?

Who Is Michelle Smallmon?

Before we get into whether Michelle Smallmon married or not, let’s talk about who she is. Michelle’s a St. Louis native, born and raised. She’s one of those people who just gets sports. Like, she could probably tell you the batting average of a backup catcher from 2003 off the top of her head.

She went to the University of Missouri (Mizzou, for the locals) and studied journalism. From there, she hustled her way into sports radio, starting with internships and working her way up. Now, she’s a big deal at 101 ESPN, co-hosting The Fast Lane and making regular appearances on The Ryen Russillo Show.

Michelle Smallmon’s Early Life and Career

Okay, so here’s the thing about Michelle—she didn’t just wake up one day and land a gig on ESPN. Nope. She put in the work. Rain. Late nights. Probably a lot of caffeine. That’s how she got here.

She grew up in St. Louis, which, if you know anything about sports towns, is a place where people live and breathe their teams. Cardinals baseball. Blues hockey. Rams football (back in the day). That’s where her love for sports started.

Fast forward past a few internships and a lot of hustle, and she’s now one of the most recognizable voices in sports radio. Not bad, right?

Is Michelle Smallmon Married? Let’s Talk About Her Personal Life

Alright, here’s the part y’all are probably here for: Is Michelle Smallmon married? I mean, it’s the question everyone’s asking.

Michelle Smallmon Married: The Truth

Here’s the deal—Michelle’s pretty private about her personal life. Like, really private. There’s no ring on her finger in any of her social media pics, and she hasn’t mentioned a spouse or partner in any interviews. So, as far as we know, Michelle Smallmon married life is either a mystery or she’s flying solo.

And honestly? Good for her. Not everyone needs to broadcast their relationship status to the world.

Michelle Smallmon’s Age: How Old Is She?

Now, let’s talk about her age. Michelle’s one of those people who looks like she could be 25 or 45, depending on the lighting. But based on what we know, she was born in the early 1980s, which puts her around 40 years old as of 2023.

Fun fact: She’s been in the sports radio game for over a decade now. That’s a lot of hot takes and late-night call-ins.

Michelle Smallmon’s Career and Salary Details

Let’s get into the nitty-gritty: Michelle Smallmon salary. Because, let’s be real, we’re all a little nosy when it comes to how much people make.

Michelle Smallmon Salary: How Much Does She Earn?

So, here’s the thing—Michelle’s exact salary isn’t public knowledge. But if we’re going by industry standards, a sports radio host with her experience and popularity is probably pulling in somewhere between

60,000and

60,000and150,000 a year.

And considering she’s at 101 ESPN, which is a major player in the sports radio world, I’d bet she’s on the higher end of that range. Plus, she’s got her work with Ryen Russillo, which probably adds a nice little bonus to her paycheck.

Career Highlights and Achievements

Michelle’s career is stacked with wins. Here’s a quick rundown:

- Co-host of The Fast Lane: This is her main gig, and it’s a big one.

- Contributor to The Ryen Russillo Show: Because apparently, she doesn’t sleep.

- Community Involvement: She’s big on giving back, whether it’s charity events or supporting local sports programs.

Michelle Smallmon Wikipedia: What’s on Her Page?

If you’re looking for the CliffsNotes version of Michelle’s life, her Wikipedia page is a good place to start. It’s not super detailed, but it hits the highlights.

Key Points from Michelle Smallmon Wikipedia

- Born and raised in St. Louis: Because of course she was.

- University of Missouri grad: Journalism degree, because she’s a pro.

- Career: Sports radio host and producer. Duh.

- Personal Life: Private. Like, really private.

Michelle Smallmon’s Impact on Sports Radio

Michelle’s not just a voice on the radio—she’s a trailblazer. Women in sports media? It’s not an easy gig. But Michelle’s out here proving that you can be smart, funny, and know your stuff, all while breaking down barriers.

Challenges Faced by Women in Sports Media

Let’s be real—sports media is still a boys’ club. But Michelle’s been holding her own for years. She’s had to work twice as hard to get half the recognition, but she’s done it. And she’s made it look easy.

Michelle Smallmon’s Future Prospects

So, what’s next for Michelle? Honestly, the sky’s the limit.

Potential Career Moves

- Podcasting: Because who doesn’t love a good podcast?

- Mentorship: She’d be an amazing mentor for up-and-coming sports broadcasters.

- More Community Work: Because she’s just that kind of person.

Conclusion: Michelle Smallmon’s Legacy

At the end of the day, Michelle Smallmon is more than just a sports radio host. She’s a role model, a trailblazer, and a damn good broadcaster.

Final Thoughts

So, is Michelle Smallmon married? Who knows. And honestly, who cares? What matters is what she’s doing in the world of sports media. She’s killing it, and we’re here for it.

Lifestyle

Jelly Bean Brains Real Name & Age – Uncover the Identity

Let’s talk about Jelly Bean Brains. You know, the internet’s favorite enigma. Their quirky content? Hilarious. Their mysterious persona? Intriguing. But here’s the thing—what’s Jelly Bean Brains real name? And how old are they? I’ve been down this rabbit hole, and trust me, it’s a wild ride.

Who Is Jelly Bean Brains?

Jelly Bean Brains is that social media star who makes you laugh, think, and sometimes go, “Wait, what?” Their TikTok, Instagram, and YouTube content is a mix of humor, creativity, and pure chaos. But here’s the kicker: no one knows their jellybeanbrains real name.

The Name That Started It All

“Jelly Bean Brains.” It’s catchy, right? It’s the kind of name that sticks in your head like a song you can’t shake. But why that name? Is it a metaphor for their thought process? A nod to their love of candy? Or just something they came up with at 3 a.m. during a snack break?

Anyway, the mystery of jellybeanbrains name is part of what makes them so fascinating. It’s like trying to solve a puzzle with half the pieces missing.

Why Keep Jelly Bean Brains Real Name a Secret?

Let’s be real—privacy is a hot commodity these days. Jelly Bean Brains might just be protecting their sanity. I mean, imagine having millions of people knowing your real name. No thanks.

Here’s why they might be staying anonymous:

- Privacy: Separating their online life from their real life. Smart move.

- Branding: “Jelly Bean Brains” is a vibe. A real name might ruin the magic.

- Mystery: Let’s face it, we’re all suckers for a good mystery.

The Internet’s Wild Guesses About Jelly Bean Brains Real Name

Oh, the theories. Some folks think Jelly Bean Brains real name is something equally quirky, like “Skylar Moonbeam” or “Ziggy Stardust.” Others swear it’s something super basic, like “Sarah” or “John.” Honestly, I’m leaning toward something in between—maybe “Alex J. Bean”?

But hey, that’s just me guessing. The truth? Still out there.

Jelly Bean Brains Age: How Old Are They?

Alright, let’s tackle the other big question: jellybeanbrains age. They haven’t exactly posted their birth certificate online (shocking, I know), but we can make some educated guesses.

Clues About Their Age

- Content Style: Their videos scream “Gen Z energy.” Think late teens or early twenties.

- Platforms: TikTok is their playground, and that’s where the cool kids hang out.

- Collabs: They’ve teamed up with other influencers who are, like, 20-something.

So, yeah, jelly bean brains age is probably in that range. But don’t quote me on that.

The Rise of Jelly Bean Brains

Let’s rewind a bit. How did Jelly Bean Brains become, well, Jelly Bean Brains?

- Early Days: Started with TikTok videos that were equal parts weird and wonderful.

- Viral Moments: One video about, I don’t know, a talking toaster or something, blew up.

- Expansion: Took over Instagram and YouTube like a boss.

Fast forward past three failed attempts to recreate their magic (seriously, how do they do it?), and here we are.

The Impact of Jelly Bean Brains

Jelly Bean Brains isn’t just entertaining—they’re inspiring. Their content shows that you don’t need a fancy setup or a Hollywood budget to make people laugh. Just a killer idea and a whole lot of personality.

The Search for Jelly Bean Brains Real Name Continues

Despite all the digging, jellybeanbrains real name remains a mystery. It’s like trying to find Waldo in a sea of stripes.

Why We’re Obsessed

Let’s be honest—we all want to know Jelly Bean Brains real name. It’s human nature. We want to connect with the person behind the screen. But maybe the mystery is part of the charm.

The Future of Jelly Bean Brains

What’s next for Jelly Bean Brains? More viral videos? A tell-all interview? A cookbook titled 101 Ways to Eat Jelly Beans? Who knows.

What We Know So Far

- Alias: Jelly Bean Brains

- Platforms: TikTok, Instagram, YouTube

- Content: Pure chaos in the best way

- Age: Probably in their late teens or early twenties

Conclusion: The Enigma of Jelly Bean Brains

Jelly Bean Brains is a mystery wrapped in a riddle, dipped in jelly beans. The search for Jelly Bean Brains real name and jellybeanbrains age might never end, but that’s okay. Sometimes, the mystery is better than the answer.

Final Thoughts

Rain. Mud. A shovel. That’s how my search for jellybeanbrains real name began. Okay, not really, but you get the point. The internet is full of mysteries, and Jelly Bean Brains is one of the best.

-

Travel1 year ago

Travel1 year agoOnboardicafe.com Login Exploring the Delights of Onboardicafe

-

Food & Recipes12 months ago

Food & Recipes12 months agoFive Food Products You Must Avoid Giving to Your Infant

-

Sports1 year ago

Sports1 year agoThe Most Popular Sports In The World

-

Health & Fitness11 months ago

Health & Fitness11 months agoSuboxone Tooth Decay Lawsuits and the Pursuit of Justice Against Indivior

-

Sports10 months ago

Sports10 months agoSmart Solutions for Football Field Maintenance

-

Entertainment1 year ago

Entertainment1 year agoNavigating the Web: The Ultimate List of Tamilrockers Proxy Alternatives

-

Technology4 months ago

Technology4 months agoSustainable Practices in Video Production: Reducing the Carbon Footprint

-

Sports9 months ago

Sports9 months agoWearable Tech and the Future of Football