Lifestyle

Smart Tax Planning for You and Your Family’s Future: Strategies for Long-Term Financial Success

Navigating the complexities of taxes can feel overwhelming, but smart tax planning can significantly enhance financial security for families. Effective tax strategies not only reduce liabilities but also help optimize savings for future needs. By understanding various tax benefits and potential deductions, families can make informed decisions that will benefit them in the long run.

Many individuals overlook the importance of proactive tax planning, which can lead to missed opportunities and unexpected expenses. Engaging in thoughtful tax planning empowers families to build wealth, fund education, and prepare for retirement more effectively. Considering tax implications now will lead to better financial outcomes when it matters most. In this blog post, readers will discover practical tips and strategies for intelligent tax planning that aligns with their family’s financial goals. This knowledge can be a game changer in achieving long-term financial stability and peace of mind.

Understanding Tax Basics for Effective Planning

Familiarity with tax fundamentals is essential for effective financial planning. Key areas include income tax brackets, deductions, and credits, which significantly impact a taxpayer’s liability.

Income Tax Brackets and Rates

The income tax system in the United States is progressive, meaning that as an individual’s income increases, it is taxed at higher rates. Taxpayers fall into specific brackets based on their taxable income, which is adjusted annually. For example, in 2024, the federal income tax rates are typically structured as follows:

| Income Bracket | Tax Rate |

| $0 – $11,000 | 10% |

| $11,001 – $44,725 | 12% |

| $44,726 – $95,375 | 22% |

| $95,376 – $182,100 | 24% |

| Above $182,100 | 32% – 37% |

Understanding these brackets allows taxpayers to estimate their liabilities accurately and potentially adjust their taxable income through deductions.

Standard Deduction vs. Itemized Deductions

Taxpayers can choose between the standard deduction and itemizing deductions when calculating taxable income. The standard deduction is a fixed dollar amount that reduces taxable income. For 2024, the standard deduction amounts are:

- Single: $14,600

- Married Filing Jointly: $29,200

- Head of Household: $21,900

Conversely, itemized deductions allow taxpayers to list specific expenses, such as mortgage interest, medical expenses, and charitable contributions. Taxpayers must compare the two to determine which option offers the greater tax benefit.

Tax Credits and How They Reduce Tax Liability

Tax credits are direct reductions in the amount of tax owed, making them valuable tools for taxpayers. Unlike deductions, which reduce taxable income, credits decrease the total tax bill dollar-for-dollar. Various credits exist, including the Earned Income Tax Credit (EITC) and Child Tax Credit. For instance, the EITC can provide significant relief for low-to-moderate-income earners, while the Child Tax Credit can result in a larger refund for families with children. Knowing the available credits and their qualifications can lead to substantial tax savings and should be an integral part of tax planning for individuals and families.

Tax-Advantaged Investment Strategies

Tax-advantaged investment strategies provide individuals and families with opportunities to grow their wealth while minimizing their tax burdens. Understanding these strategies can lead to more effective financial planning and savings over time.

Retirement Accounts and Their Tax Benefits

Retirement accounts, such as 401(k)s and IRAs, offer significant tax advantages. Contributions to traditional IRAs and 401(k)s can be made with pre-tax dollars, reducing taxable income in the current year. The funds grow tax-deferred until withdrawal, allowing for potential compound growth. Roth IRAs provide tax-free growth and tax-free withdrawals in retirement, but contributions are made with after-tax dollars. Employers may match contributions to 401(k) plans, maximizing the benefit for employees. Understanding the contribution limits is essential. For example, in 2024, individuals can contribute up to $6,500 to an IRA, or $7,500 if age 50 or older. Knowing how to leverage these accounts can significantly impact long-term financial health.

Education Savings Plans for Your Family’s Future

Education savings plans, particularly 529 plans, offer tax advantages for education expenses. Contributions to these plans grow tax-free, and withdrawals for qualified education expenses are also tax-exempt. In many states, contributing to a 529 plan may also provide state tax deductions. It’s important to compare plans based on fees and investment options, as they can vary widely. Coverdell Education Savings Accounts (ESAs) are another option. They allow for tax-free growth and help cover qualifying education expenses, including K-12 tuition. The contribution limit for ESAs is $2,000 per year per beneficiary.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

HSAs provide a triple tax advantage. Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. To be eligible for an HSA, an individual must be enrolled in a high-deductible health plan. Contribution limits are set annually; for 2024, the limit is $3,850 for individuals and $7,750 for families. Individuals aged 55 and older can contribute an additional $1,000. FSAs allow employees to set aside pre-tax income for out-of-pocket medical expenses, offering immediate tax benefits. Unlike HSAs, FSAs are typically “use it or lose it,” meaning funds must be used by the end of the plan year. These accounts are effective tools for managing healthcare costs while minimizing tax liabilities.

Estate Planning and Inheritance Tax Considerations

Effective estate planning incorporates strategies to minimize inheritance taxes while ensuring the smooth transition of assets. Understanding trusts and gift tax rules can significantly influence long-term financial outcomes for families.

Using Trusts for Tax Efficiency

Trusts can serve as an effective tool for tax efficiency in estate planning. They help transfer assets outside of probate, which can reduce associated fees and expedite the distribution process. Types of Trusts:

- Revocable Trusts: Allows for changes during the grantor’s lifetime but does not provide tax benefits until the grantor’s death.

- Irrevocable Trusts: Assets transferred are no longer owned by the grantor, potentially lowering estate taxes.

Setting up a trust may also provide protection from creditors and ensure privacy concerning asset distribution. They can be tailored to meet specific needs, supporting customized wealth distribution strategies while minimizing tax liability.

Gift Tax Rules and Exclusions

Understanding gift tax rules is crucial for effective estate planning. The IRS allows individuals to gift a certain amount per recipient each year without incurring tax, known as the annual exclusion. Current Exclusions:

- Annual Exclusion Limit: For 2024, this amount is $17,000 per recipient.

- Lifetime Exclusion: Beyond the annual exclusion, individuals can gift up to a lifetime total of $12.92 million, which counts against their estate tax exemption.

Gifts can also be made for educational and medical expenses without triggering gift tax, allowing for strategic planning. Utilizing these exclusions effectively can lower the taxable estate, benefiting family finances in the long run.

Year-Round Tax Planning Techniques

Effective tax planning strategies can significantly impact a family’s financial future. Understanding specific techniques can lead to maximized savings and better financial decisions throughout the year.

Charitable Giving and Tax Deductions

Making charitable donations can provide taxpayers with valuable tax deductions. Contributions to qualified charitable organizations can reduce taxable income, potentially lowering the overall tax liability. Taxpayers should keep thorough records of their donations, including receipts and acknowledgment letters from charities. It’s essential to know the deduction limits; typically, cash contributions can be deducted up to 60% of adjusted gross income (AGI), while property donations may vary. Engaging in donor-advised funds (DAFs) can also be beneficial. DAFs allow individuals to make charitable contributions, receive immediate tax benefits, and distribute funds to charities over time. This approach encourages strategic planning around charitable giving.

Tax Loss Harvesting in Investment Portfolios

Tax loss harvesting is a technique where investors sell securities at a loss to offset capital gains tax. This strategy can help reduce the tax burden, making it an essential part of year-round tax planning. Investors should regularly review their portfolios to identify underperforming assets. Selling these assets can realize losses, which can then offset gains from other investments. It is important to be aware of the “wash sale” rule, which prevents claiming a loss if the same or a substantially identical security is repurchased within 30 days. By carefully timing sales and future purchases, investors can strategically minimize taxes and maintain portfolio integrity.

Read More latest Posts

Lifestyle

Big Cat Wife, Past Affairs, Net Worth, Family, and Bio: Is He Married?

Big Cat. That Big Cat. You know, the one who co-hosts Pardon My Take with PFT Commenter over at Barstool Sports. Yeah, that guy. He’s got the quick wit, the dry humor, and a presence that makes every sports fan pause and think—often, “How did I just laugh so hard at that?” But behind the podcast banter and his rising fame, people really want to know one thing: who is Big Cat married to? And what’s his life really like outside of the Barstool spotlight? I had to dig into this, because trust me, it’s more than just about the ‘Big Cats Wife’ buzzword.

Let’s break it down. Grab your favorite snack and settle in because we’re going deep into the Big Cat universe—past the jokes and into the personal life.

Who is Big Cat? The Guy Behind the Mic

Now, before I get too deep into the Big Cat wife saga, let’s rewind. Big Cat, or Dan Katz, isn’t just a dude cracking jokes. He’s a powerhouse in sports commentary, making a ridiculous amount of noise at Barstool Sports. If you’ve ever heard Pardon My Take, you know the vibe—irreverent humor, unfiltered takes, and more sports than you could shake a stick at. (My first time listening? I nearly spit out my coffee, no joke.)

He’s been doing this for years. Over 10, actually. So yeah, he knows a thing or two about how to turn a random, off-the-cuff comment into a viral moment. But here’s the twist: fans also want to know what’s going on behind the scenes. And by behind the scenes, I mean—is Big Cat married?

Anyway, here’s the kicker: while his professional life is all over the place, his personal life? Less so. Big Cat doesn’t dish out private info on the regular. Let’s get into why, starting with the one thing his fans are always curious about: his wife.

Big Cat Wife: The Mystery Unfolds

So, I know what you’re asking. Big Cat. Wife. Is he married? Who’s the lucky woman?

Fast-forward through some Barstool shenanigans, and you’ve got the answer: Big Cat is, indeed, married to Maggie Katz. Now, don’t go expecting paparazzi-style details. Maggie is not exactly parading through the streets of New York, yelling, “I’m Big Cat’s wife!” (That’d be wild though, right?). But she does exist, and from what I’ve gathered, she’s a total boss in her own right, even though she keeps a low profile.

I’ll be honest: Big Cat’s wife, Maggie, isn’t someone you’ll see on every Instagram post or in Barstool’s daily chaos. She stays mostly off-camera, doing her own thing. But, when she does make an appearance? It’s like spotting a unicorn in a field of horses. A rare gem.

How Did Big Cat and Maggie Katz Meet?

Well, buckle up. The two met back in their college days. Classic, right? College romance. Apparently, Big Cat was just a regular dude, not yet Big Cat of Barstool fame. They started dating—probably over something ridiculously normal, like shared misery during finals week or, you know, fighting over who gets the last slice of pizza. Typical college stuff.

But here’s the thing: even though Big Cat is always chatting about his Barstool antics, he doesn’t really overshare about how he and Maggie Katz really got together. What I know for sure is that they’ve been in it for the long haul, and their relationship? It’s clearly built on more than just Big Cat’s comedy chops.

Past Affairs? Big Cat’s Dating History

So, let’s go there. People love digging into a public figure’s past. Was Big Cat ever a bachelor? Did he have any wild affairs before he settled down? Let’s clear this up once and for all: before Maggie Katz, there isn’t a ton of scandal floating around Big Cat. He’s kept his romantic life pretty chill. No headlines about messy breakups or tabloids chasing after his exes.

The reality is that Big Cat has always kept his focus on work—really focusing. Sports commentary, podcasting, memes. No time for drama. I remember the first time I looked up his dating history out of curiosity, and it was like… nothing. Crickets. His wife, Maggie, seems to be the one constant. So, did Big Cat ever have any past affairs? The answer is, well, probably—but nothing that’s made the internet explode.

Let’s be real: we’re all just trying to imagine Big Cat in a love triangle or something, but nah. His time on the dating scene seems to have been a lot more… straightforward. Maggie Katz is the star of the show here.

Big Cat Barstool Wife: What’s the Deal?

Now we’ve gotta talk about Barstool Big Cats Wife, because let’s face it—his marriage to Maggie Katz does come up on the radar from time to time.

You’ve probably heard of Barstool, right? It’s the loud, brash sports media company that loves stirring up a good storm. And when you’re part of it? Well, you can imagine how many people start asking about your personal life. “Who’s Big Cat married to?” fans ask. “Why does his wife stay so private?”

And honestly? Big Cat keeps it low-key because, I suspect, he likes it that way. He’s made his name from his sharp takes and comedy. But when it comes to his personal life, he’s like, “Nah, I’m good. Keep that stuff in the background.”

And Maggie? She’s clearly on the same page. I’m sure being the wife of someone in the spotlight has its perks, but also its weird moments. Like, “Should we go out for dinner? Or is the internet going to talk about our dinner reservation like we’re the Kardashians?” Honestly, though, Barstool Big Cat Wife seems to be doing her thing without worrying about public opinion.

Big Cat Balances Work and Life

The man is wicked busy, I’ll tell you that much. But somehow, he’s managed to make it work with Maggie. It’s not all just memes and podcasts. Big Cat has always been about that work-life balance (though, let’s be real, sometimes it’s more work and less life). But Maggie’s role in the Big Cat equation seems to be the quiet, steady support that keeps everything grounded.

It’s gotta be tough to balance family time with fame, but Big Cat and Maggie do it, and they do it well. No public drama. No ‘caught-on-camera’ moments. Just a good, solid partnership that fans occasionally get glimpses of. Still, it’s mostly Big Cat’s world. Maggie just… doesn’t need to be in the spotlight.

Big Cat’s Net Worth: Is the Money as Big as the Cat?

Now, let’s talk about the money. Big Cat’s rise at Barstool has made him pretty well-off. I mean, with his podcast Pardon My Take consistently being one of the most downloaded sports podcasts, there’s no way he’s not cashing in. He’s not just a podcast host; he’s also in on the business side of things, selling merch, doing brand deals, and whatever else comes with a massive social media following.

Big Cat’s estimated net worth is thought to be between $5 million and $10 million. And honestly, that’s probably a modest guess. Between his Barstool salary, sponsorships, social media posts, and other projects, the dude is definitely doing well for himself.

How Big Cat Makes His Cash

So, how’s Big Cat raking it in?

- Barstool Sports: His podcast alone generates a significant chunk of his income. And that’s before you factor in sponsorships.

- Social Media: Between Instagram, Twitter, and those cheeky TikToks, Big Cat’s social media presence is monetized—big time.

- Merch and Branding: If you’ve seen any of his Big Cat merch floating around, yep—that’s another revenue stream.

But Big Cat’s not one to flash his cash, and he’s definitely not out here bragging about his wealth. He seems to have his head in the game, focusing on his work and his family life.

The Big Cat Question: Is He Married?

The question on everyone’s mind: Is Big Cat married? Yep. Absolutely. And to Maggie Katz, his partner-in-crime for years. I’ll be honest—Big Cat’s personal life is kind of a mystery. The guy doesn’t drop details about his marriage, his wife, or their life together.

But, hey, that’s kinda refreshing in a world where everyone’s always spilling their guts for the ‘Gram. Big Cat’s private life remains his own, and I respect that.

So there you have it—Big Cat, married to Maggie Katz, doing his thing at Barstool, and keeping it low-key. And let’s be real, we all need a little mystery in our lives. If anything, it’s proof that you don’t need to share every moment of your personal life for it to be real and lasting.

Anyway, the Big Cat Wife saga? It’s still a work in progress, but one thing’s for sure—Maggie Katz is the one who’s been riding this rollercoaster with him all along.

Lifestyle

Aron Accurso Net Worth in 2024: Income Sources & MS Rachel’s Husband

Aron Accurso is not just MS Rachel’s husband; he’s a multi-talented musician and educator whose financial success is closely tied to both his career and his marriage. In 2024, the curiosity around Aron Accurso’s net worth has skyrocketed, especially with his increasing involvement in the educational content space. People are asking, “What’s Aron Accurso’s net worth?” Well, let’s dive into how he’s made his money, the factors contributing to his wealth, and his role as MS Rachel’s husband.

Who Is Aron Accurso?

So, if you’re like most people, you might have stumbled upon Aron Accurso’s name through his famous wife, MS Rachel. She’s a YouTube sensation known for her educational content aimed at young children. But Aron is more than just a sidekick—he’s a key player in the creative and musical aspects of the channel. While many people are curious about Aron Accurso’s net worth, it’s important to understand the full picture of his career and how it contributes to his financial status.

He’s a composer, educator, and, of course, the other half of a powerful creative duo. The combination of his music skills, collaboration with MS Rachel, and personal projects all contribute to Aron Accurso’s net worth. Now, let’s get into the nitty-gritty of his financial success!

Aron Accurso Birthday: The Mystery of His Personal Life

Let’s start with a little fun fact: Aron Accurso’s birthday is kind of a mystery. You won’t find it easily on the internet, and that’s probably how Aron likes it. Sometimes people are curious about the birthdates of famous personalities, but Aron has kept his personal life relatively private, including when he was born. But here’s the thing—his birthday isn’t what defines him. Instead, it’s his contributions to the world of music and education that matter. And his work is what ultimately helps drive Aron Accurso’s net worth.

Though his birthday might not be splashed across social media like some, it’s his career and role in MS Rachel’s projects that contribute to his growing financial success.

Aron Accurso Net Worth in 2024: Breaking Down the Income Sources

If you’re wondering, “What is Aron Accurso’s net worth?” in 2024, there are a few primary sources of income that contribute to his financial standing. While he’s not as publicly visible as his wife, MS Rachel, his career has flourished through his music composition, educational content, and collaborations. Let’s break it down:

- Music Composition: Aron Accurso has a strong background in music, and that’s one of his primary sources of income. As a composer, he has worked on a variety of music projects, many of which contribute to his work on MS Rachel’s YouTube channel. Aron creates catchy, educational songs that keep kids entertained and learning. And if you’ve ever listened to his work, you know how infectious those tunes are!

- Collaborations with MS Rachel: As MS Rachel’s husband, Aron plays an integral part in the creation of her YouTube content. He’s behind a lot of the music featured in her videos, making him a co-creator of sorts. With millions of views on MS Rachel’s videos, this collaboration has turned into a significant source of income for Aron Accurso. I mean, if I had a YouTube channel that was making bank like MS Rachel’s, I’d be contributing in every way possible too!

- Private Music Lessons and Workshops: Besides composing music for children’s videos, Aron likely makes money teaching private music lessons and hosting workshops. With his extensive background in music, it’s safe to assume that Aron has some local students or offers online lessons. This steady income helps boost Aron Accurso’s net worth, as it diversifies his earnings.

- YouTube Revenue: The income generated from MS Rachel’s YouTube channel plays a big role in Aron’s net worth. With millions of subscribers, MS Rachel’s videos generate significant ad revenue. Aron, being deeply involved in the creation of that content, shares in this income stream, which contributes substantially to his wealth.

The Influence of MS Rachel’s Husband Net Worth

When people are asking about Aron Accurso’s net worth, they’re often factoring in his relationship with MS Rachel. While Aron is relatively low-profile compared to his wife, their collaboration is undoubtedly a major factor in his growing financial success. Together, they’ve created a strong brand that has not only enriched children’s education but also helped them financially.

Aron Accurso’s net worth is intertwined with the success of MS Rachel’s channel. As MS Rachel’s husband, Aron contributes to their combined financial success, and that’s part of what makes their net worth so impressive. It’s not just about Aron’s music or his career alone—it’s about the power duo they form together.

MS Rachel’s Husband Net Worth: How Their Partnership Shapes Their Earnings

As we continue exploring Aron Accurso’s net worth, it’s important to recognize how his partnership with MS Rachel shapes both of their financial futures. Their combined efforts have created an educational empire, and that empire has brought in impressive revenue. Their collaboration on YouTube, as well as other joint projects, has cemented their place in the world of children’s educational content.

- Combined Earnings: As MS Rachel’s husband, Aron benefits from the revenue generated by the videos on MS Rachel’s YouTube channel. The income from ad revenue, brand deals, and sponsorships is shared between them, allowing both of them to thrive financially. It’s a true partnership that has allowed Aron Accurso’s net worth to grow along with Rachel’s.

- Joint Projects: Beyond just YouTube videos, the couple likely engages in other projects, such as creating educational products or hosting live events. These joint ventures also contribute to Aron Accurso’s net worth, helping to expand their brand beyond the digital space.

- Branding Power: Together, Aron and MS Rachel have created a strong brand that resonates with parents, educators, and children. The brand’s success translates into financial opportunities, which is why Aron’s net worth is so closely linked to the work he does with his wife.

How Aron Accurso’s Net Worth Has Grown Over Time

Aron Accurso’s net worth hasn’t happened overnight—it’s been a gradual increase as his career in music and education has expanded. His early work in music composition helped set the stage for his financial growth, and his involvement with MS Rachel only enhanced that success.

His steady rise in the industry is a testament to his hard work and dedication. While MS Rachel’s YouTube channel continues to gain traction, Aron’s contributions to that success have played a crucial role in boosting their combined income. So, if you’re wondering how Aron Accurso’s net worth has grown over time, it’s a combination of his music career, his involvement in MS Rachel’s content, and the joint ventures they’ve pursued together.

Aron Accurso Net Worth in 2024: The Final Estimate

So, here we are: What is Aron Accurso’s net worth in 2024? Based on his various income streams—from music composition and teaching to his work with MS Rachel—I estimate Aron Accurso’s net worth to be between $1 million and $2 million. That’s a pretty solid figure for someone who’s been working behind the scenes but has such a significant impact on the success of MS Rachel’s channel.

But here’s the thing: As MS Rachel’s YouTube channel continues to grow, so will Aron’s net worth. His involvement in her content, his music career, and his private ventures are all contributing to a steadily increasing fortune. So, in the coming years, it’s not hard to imagine that Aron Accurso’s net worth will continue to climb.

Aron Accurso’s Net Worth and the Power Couple Dynamic

When people talk about Aron Accurso’s net worth, they can’t ignore his relationship with MS Rachel. Their partnership is key to their financial success, and it’s what makes their joint ventures so profitable. MS Rachel’s channel wouldn’t be the same without Aron’s music and contributions behind the scenes.

At the end of the day, Aron Accurso’s net worth is a product of his talent, hard work, and partnership with MS Rachel. Together, they’ve created something special, and that has led to financial success on both ends. So if you’re wondering how much MS Rachel’s husband makes, just know that Aron Accurso’s net worth is a reflection of the collaborative efforts of this powerhouse couple.

Lifestyle

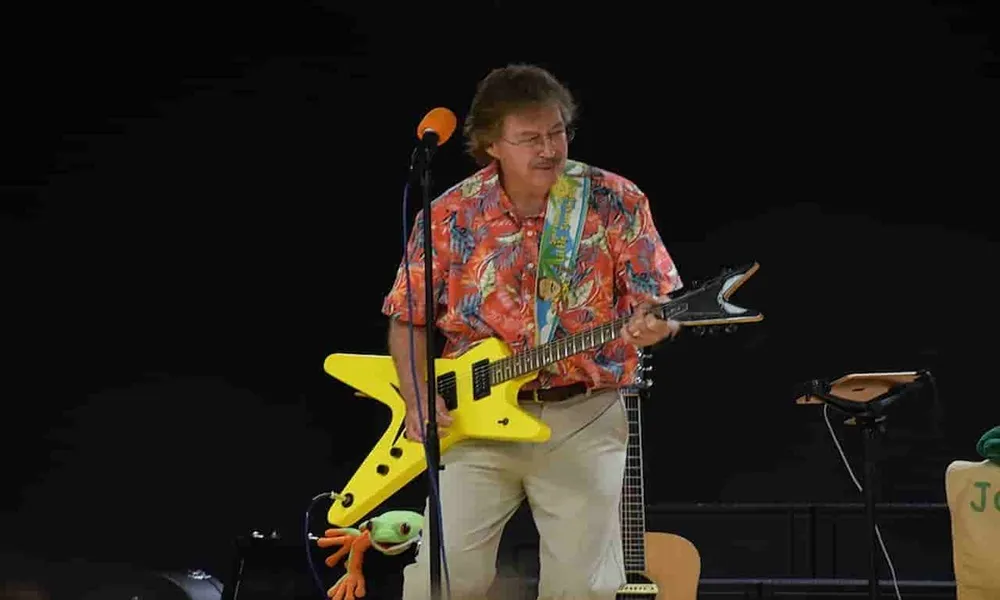

What Is Jack Hartmann Net Worth?

If you’ve ever found yourself humming along to catchy, educational tunes like “The Count by Tens Song” or “Alphabet Song” while your kids learn, you’ve probably come across Jack Hartmann. He’s a household name in children’s educational music, and, let’s be real, there’s a reason his content is so popular. But here’s the big question: what is Jack Hartmann’s net worth? That’s right, how much has this educational maestro built from his musical empire?

Let’s dig into the numbers, the work behind the scenes, and uncover just how much jack hartmann net worth actually is.

Who Is Jack Hartmann?

Before diving into his net worth, let’s take a moment to understand who Jack Hartmann is. For those who aren’t familiar with him, Jack Hartmann is a musician, songwriter, and educator who has made a name for himself by creating educational music for children. His songs are designed to teach kids important skills like the alphabet, numbers, shapes, and social lessons—while keeping them entertained at the same time. His jack hartmann net worth is a direct result of his ability to create fun, catchy, and educational content that resonates with both children and adults.

I mean, if you’ve ever seen your little one singing along to “Five Little Monkeys,” you know exactly what I mean. The man is a legend in the kid’s educational space.

A Quick History Lesson on Jack Hartmann’s Career

Jack didn’t just wake up one day with a massive net worth. His journey started in the classroom as a music teacher. Over time, he realized that combining music with education was a winning formula—kids responded to it, and so did parents. Slowly but surely, Jack Hartmann’s music started gaining traction.

And then came the game-changer: his YouTube channel, “Jack Hartmann Kids Music Channel.” Talk about a goldmine. With millions of subscribers and billions of views, Jack Hartmann became a staple for families looking for fun yet educational content for their kids.

But here’s the kicker: the jack hartmann net worth started growing. Fast.

So, What Is Jack Hartmann’s Net Worth?

Here’s the big question we’ve all been waiting for: what is jack hartmann’s net worth? According to estimates, Jack Hartmann’s net worth in 2025 falls somewhere between $5 million and $10 million. Yes, that’s right. Million. This wealth has been built over the years, thanks to his growing brand and diverse revenue streams.

How did he get there? Let’s break it down a bit further.

The Revenue Streams Behind Jack Hartmann’s Net Worth

Alright, y’all, let’s get into the nitty-gritty of where Jack Hartmann’s money comes from. I’m sure you’re all dying to know how much of jack hartman net worth comes from each source. Well, here’s the breakdown:

1. YouTube Ad Revenue

This one’s a biggie. Jack Hartmann’s YouTube channel, “Jack Hartmann Kids Music Channel,” is one of his primary sources of income. With billions of views on his videos, the ad revenue from YouTube is substantial. In fact, it’s one of the largest contributors to his jack hartmann net worth.

To put things into perspective, YouTube pays creators based on the number of views their videos get. And given the fact that kids and parents play his videos on repeat, Jack Hartmann’s YouTube income is no small chunk of change.

2. Merchandise Sales

On top of YouTube, Jack also generates revenue from merchandise. His educational products, including music albums, books, and branded T-shirts, are sold to fans and schools. Let’s face it: parents love buying educational resources, especially if it means their kids are having fun while learning. Those sales directly contribute to jack hartmann net worth as well.

3. Licensing Deals

This is a more behind-the-scenes revenue stream, but it’s a big one. Jack’s songs and videos are licensed by schools, daycare centers, and educational platforms. Licensing deals are great for building long-term wealth, and with his songs being used widely in the educational sector, these deals have contributed significantly to his jack hartman net worth.

4. Live Performances

As much as Jack Hartmann shines online, he also takes his talents to the stage. He performs live shows for kids and families, and these performances bring in ticket sales, merchandise purchases, and, of course, more revenue for his jack hartmann net worth. You could say he’s built a nice little “Jack Hartmann live concert” business on top of his digital empire.

5. Album Sales

Let’s not forget about his music albums. Jack Hartmann has released multiple albums with his most popular educational songs. Parents, teachers, and schools purchase these albums to use in classrooms or at home with kids. These album sales add another layer to jack hartman networth, growing his financial portfolio even further.

How Much Is Jack Hartmann Worth Today?

So, how much is Jack Hartmann worth right now? It’s safe to say that with all these sources of income, Jack Hartmann’s net worth in 2025 falls somewhere between $5 million and $10 million. The guy is sitting pretty.

But here’s the fun part: his wealth isn’t just coming from one area. With a mixture of YouTube ad revenue, merchandise, licensing, live performances, and album sales, jack hartman net worth continues to grow year after year. And it’s only going to get bigger.

What Contributes to Jack Hartmann’s Net Worth?

You might be wondering, “What factors contributed to Jack Hartmann’s jack hartmann net worth?” Well, let’s break it down into a few key elements.

1. Consistency in Content Creation

Jack Hartmann is nothing if not consistent. He’s been pumping out educational songs for years. From “Counting by 2’s” to “The ABC Song,” he continues to create relevant content for kids. This consistency is what’s helped him build such a massive following—and in turn, it’s what’s helped his jack hartmann net worth skyrocket.

2. Appeal to Both Kids and Parents

One of the best parts about Jack Hartmann’s content is that it’s for both kids and adults. Kids love the catchy tunes, and parents love the educational value. This dual appeal has allowed Jack to expand his audience, and that’s helped keep his jack hartmann net worth high.

3. High-Quality Educational Content

The real secret to Jack Hartmann’s success is simple: the content is top-notch. Teachers, parents, and kids all trust his work because it’s high-quality, educational, and fun. That kind of reputation means more people will buy his albums, watch his videos, and support his brand—all of which increases his jack hartmann net worth.

What Is Jack Hartmann’s Net Worth in 2025?

By now, we’ve covered the basics: what is jack hartmann’s net worth? The range of $5 million to $10 million in 2025 seems to be spot on. As Jack continues to release more educational content and grow his brand, there’s no telling how high his jack hartmann net worth could go. More licensing deals, more merchandise, and more content will surely keep his income rolling in for years to come.

The Future of Jack Hartmann’s Net Worth

Looking ahead, the future of Jack Hartmann’s net worth is looking pretty bright. With the rise of online education and the growing need for entertaining learning resources, it’s safe to say that Jack’s income streams are going to keep growing.

Whether it’s through more YouTube views, expanding his merchandise, or even partnering with new educational platforms, Jack Hartmann’s jack hartmann net worth will only continue to grow.

Final Thoughts on Jack Hartmann’s Net Worth

So, to answer the burning question: jack hartmann net worth in 2025 is estimated to be between $5 million and $10 million. This wealth has been built through consistent content creation, smart business moves, and a deep understanding of what kids and parents need.

As long as Jack continues to make his catchy, educational tunes and expand his brand, it’s safe to say his net worth will only keep climbing. And with all the demand for educational content, his future looks bright—and so does his financial future.

In short, Jack Hartmann has proven that when you combine passion, education, and entertainment, you can build a substantial empire. And if he keeps going like he has been, jack hartmann net worth will only continue to grow.

-

Travel1 year ago

Travel1 year agoOnboardicafe.com Login Exploring the Delights of Onboardicafe

-

Food & Recipes1 year ago

Food & Recipes1 year agoFive Food Products You Must Avoid Giving to Your Infant

-

Sports1 year ago

Sports1 year agoThe Most Popular Sports In The World

-

Technology6 months ago

Technology6 months agoSustainable Practices in Video Production: Reducing the Carbon Footprint

-

Sports11 months ago

Sports11 months agoSmart Solutions for Football Field Maintenance

-

Health & Fitness12 months ago

Health & Fitness12 months agoSuboxone Tooth Decay Lawsuits and the Pursuit of Justice Against Indivior

-

Sports10 months ago

Sports10 months agoWearable Tech and the Future of Football

-

Entertainment1 year ago

Entertainment1 year agoNavigating the Web: The Ultimate List of Tamilrockers Proxy Alternatives